The Fundamental Review of the Trading Book (FRTB) is a set of global regulatory standards developed by the Basel Committee on Banking Supervision to address shortcomings in the current market risk framework. The FRTB aims to improve the measurement and management of market risk in banks' trading books, ensuring that banks hold adequate capital to cover potential losses.

Key components of the FRTB include:

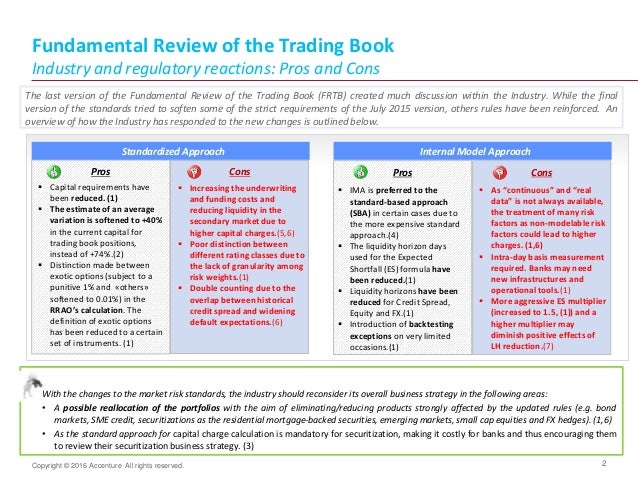

1. Revisions to the standardized approach for market risk, including the introduction of a more risk-sensitive calculation methodology.

2. The implementation of a revised internal models approach, which requires banks to have robust risk management processes in place and to demonstrate the accuracy and reliability of their risk models.

3. The introduction of a new risk management tool called the expected shortfall, which provides a more comprehensive measure of potential losses than the current value-at-risk metric.

4. Enhanced disclosure requirements to promote greater transparency and accountability in banks' market risk management practices.

The FRTB is intended to strengthen the resilience of the banking system by ensuring that banks have sufficient capital to cover their market risk exposures, ultimately reducing the likelihood of market disruptions and financial crises.